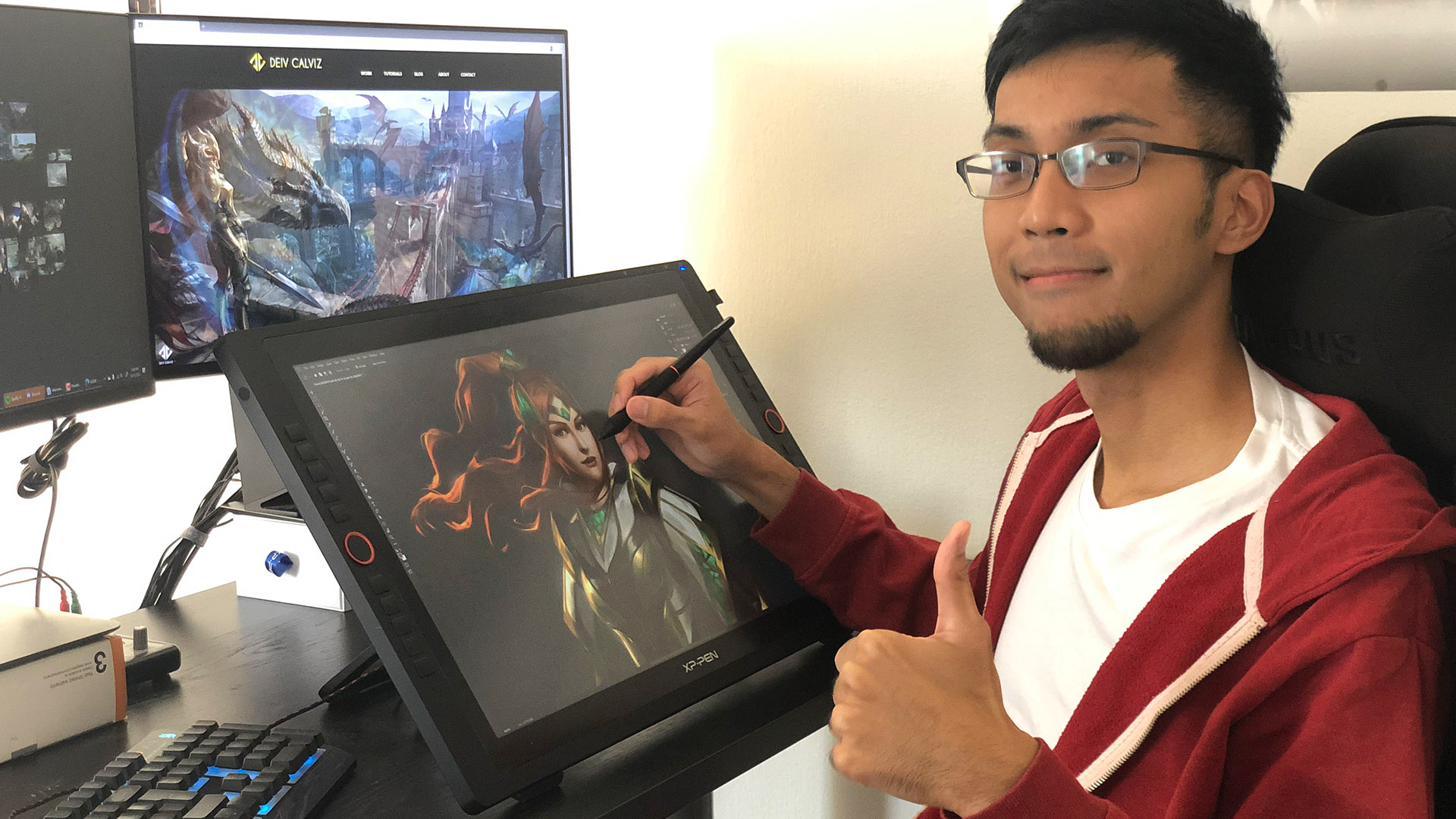

Huion sent me the Kamvas 13 to review. It is advertised as a first choice for beginners who want to try the pen display tablet.

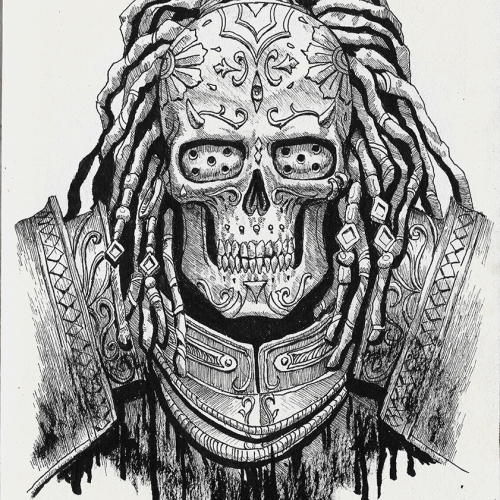

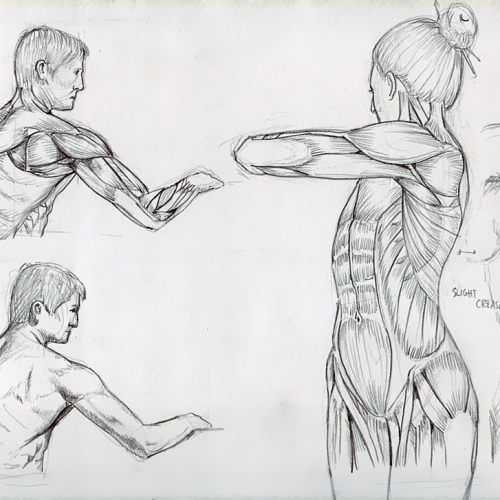

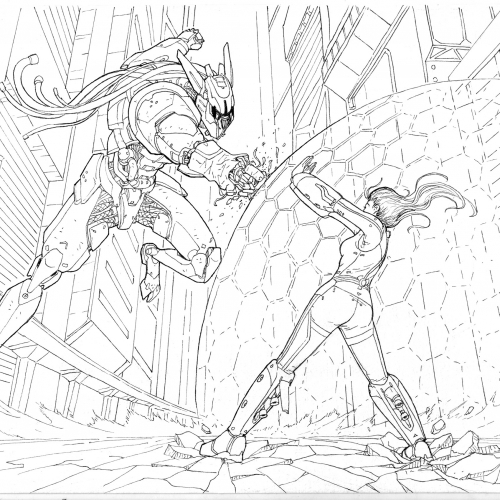

I made a quick artwork while using this to test it out and I can say this product is very high quality and easy to use for something very affordable.

Contents

The Box contains the following:

- Kamvas 13 Pen Display

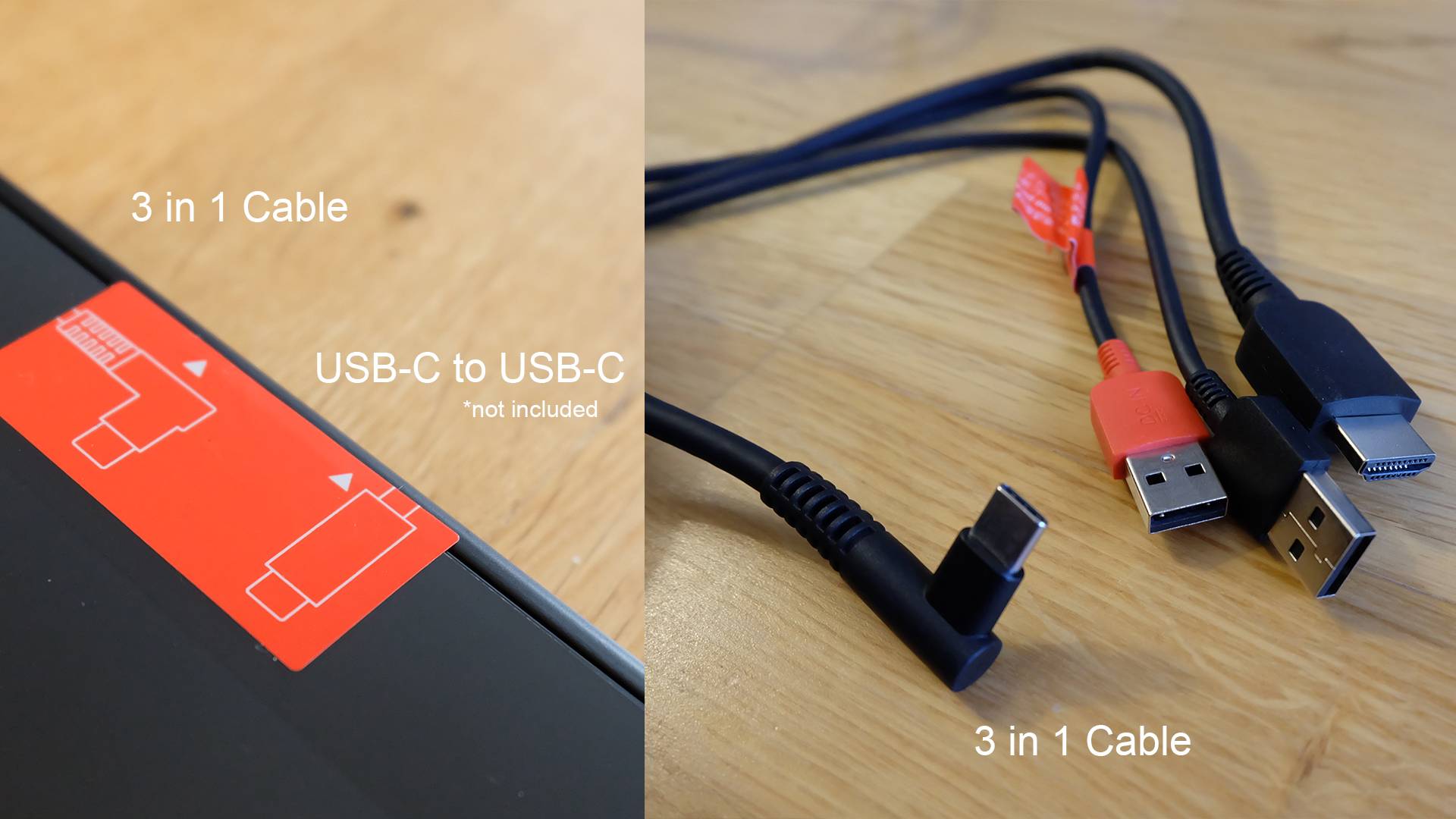

- 3 in 1 Cable

- USB Extension Cable

- Battery-free Pen PW517

- Pen Holder PH05A

- Pen Nibs x 10

- Pen Nib Clip

- Glove

- Cleaning Cloth

- Quick Start Guide booklet

Everything is well built and it’s always great to have the extras like the glove, cloth, and extra nibs.

Setting Up

There are two ways to connect this to a computer. The first way is to use the 3 in 1 Cable that requires 2 USBs and one HDMI slot on your computer.

The second method is to use the USB-C to USB-C cable. This method requires devices that support USB3.1 Gen1, DP1.2 and above standards. The USB-C to USB-C cable can be purchased separately in their store. 3rd party USB-C cables are not supported because of the custom size of the slot.

Stand

The stand is not included in the base product but can be added on when purchasing. I think it is necessary if you don’t want to strain your neck while using this.

It can be adjusted between 20 to 60 degrees and is made of sturdy plastic and metal. I did not encounter any wobbling while using this.

Stylus

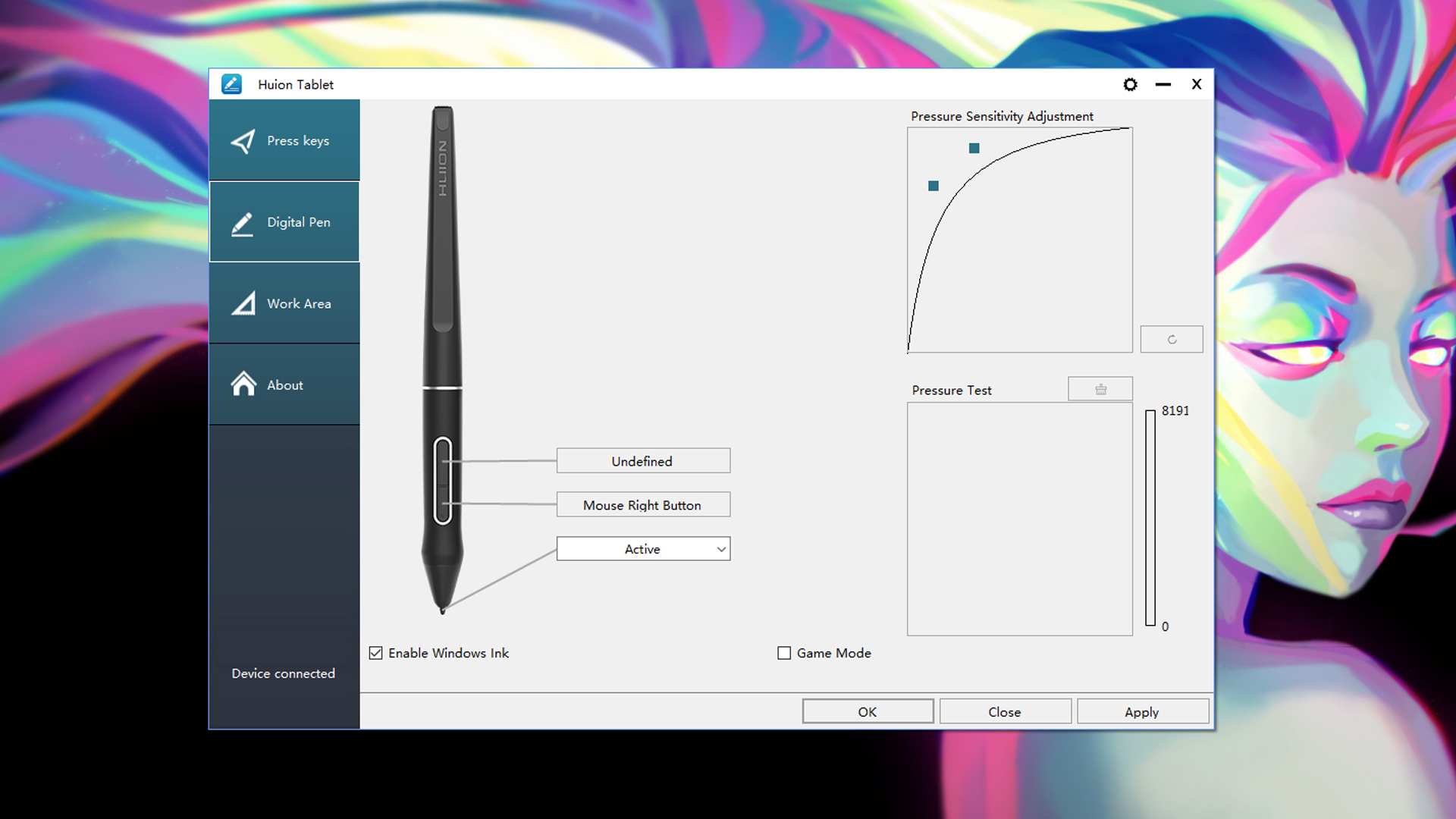

The pen feels comfortable and nicely made. It has two customizable side buttons. The pen stand can be opened up to reveal 10 spare nibs and a nib remover clip. I really like this pen holder because it’s very stable and it’s easy to fit the pen in the slot.

The battery free stylus works well and I did not encounter and hiccups with the pressure. It has 8192 levels of pressure with 60 degrees of tilt function. The accuracy is great. I did not need to calibrate it.

I also really like the texture of the anti-glare protective film. It feels a bit like drawing on paper without it affecting the colors of the screen.

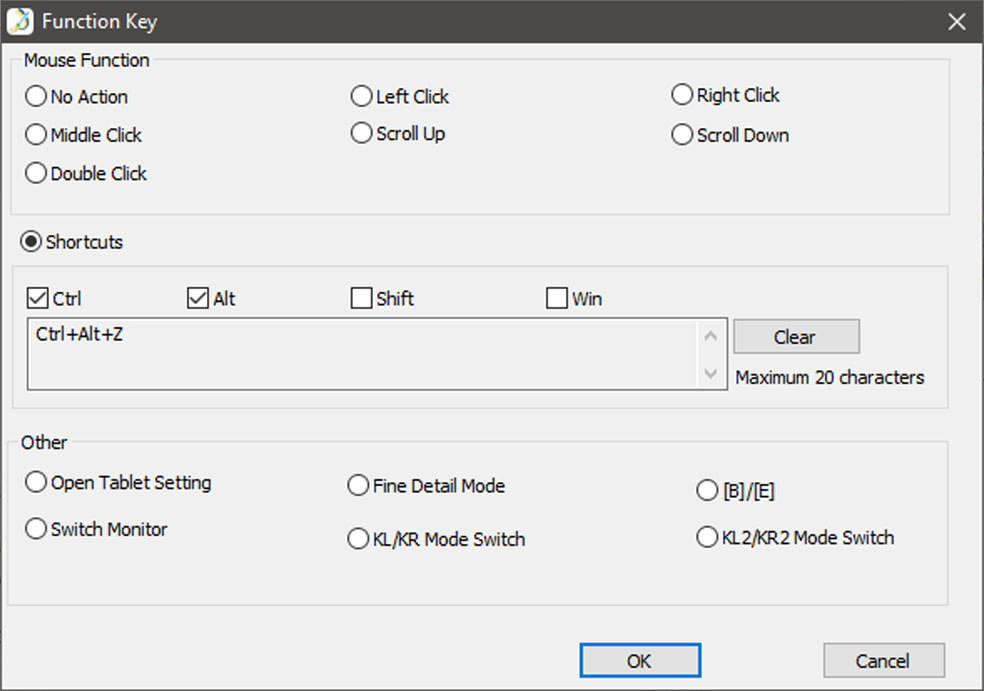

8 Press Keys

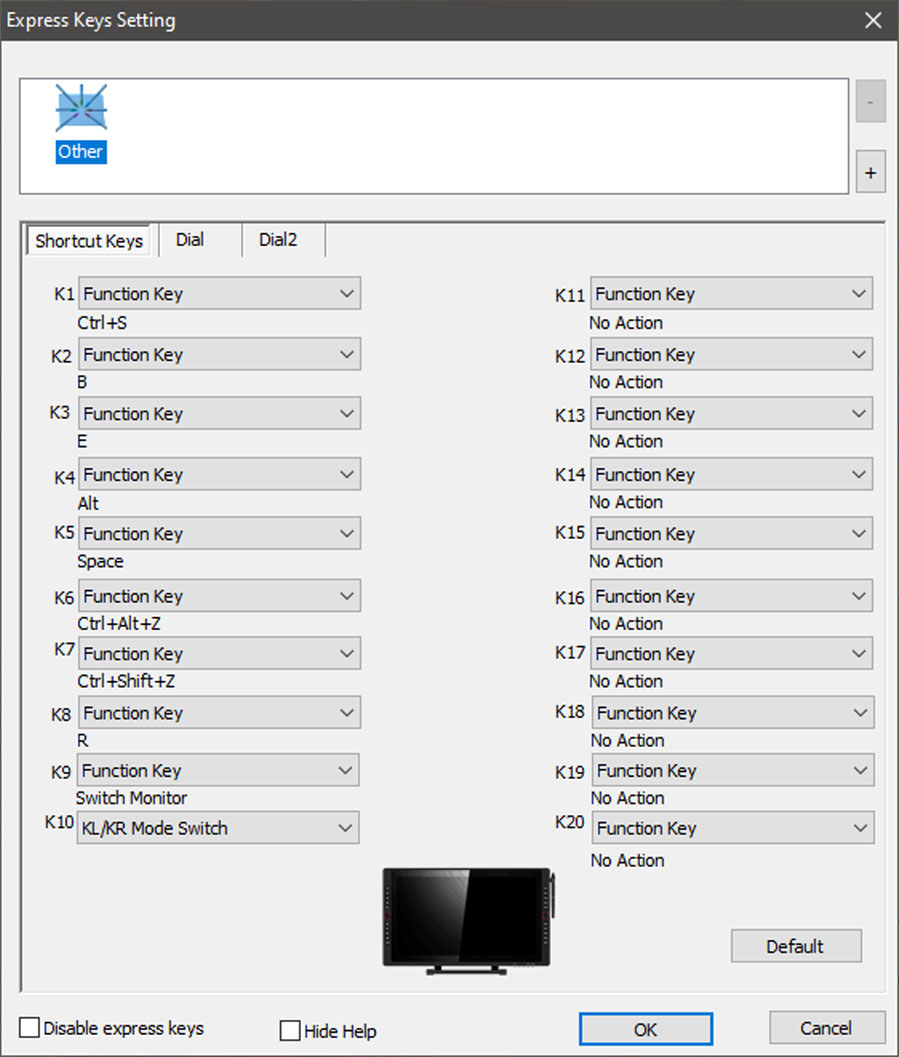

The 8 Press Keys are all customizable. I like the round buttons which gives it a smooth feel.

Software

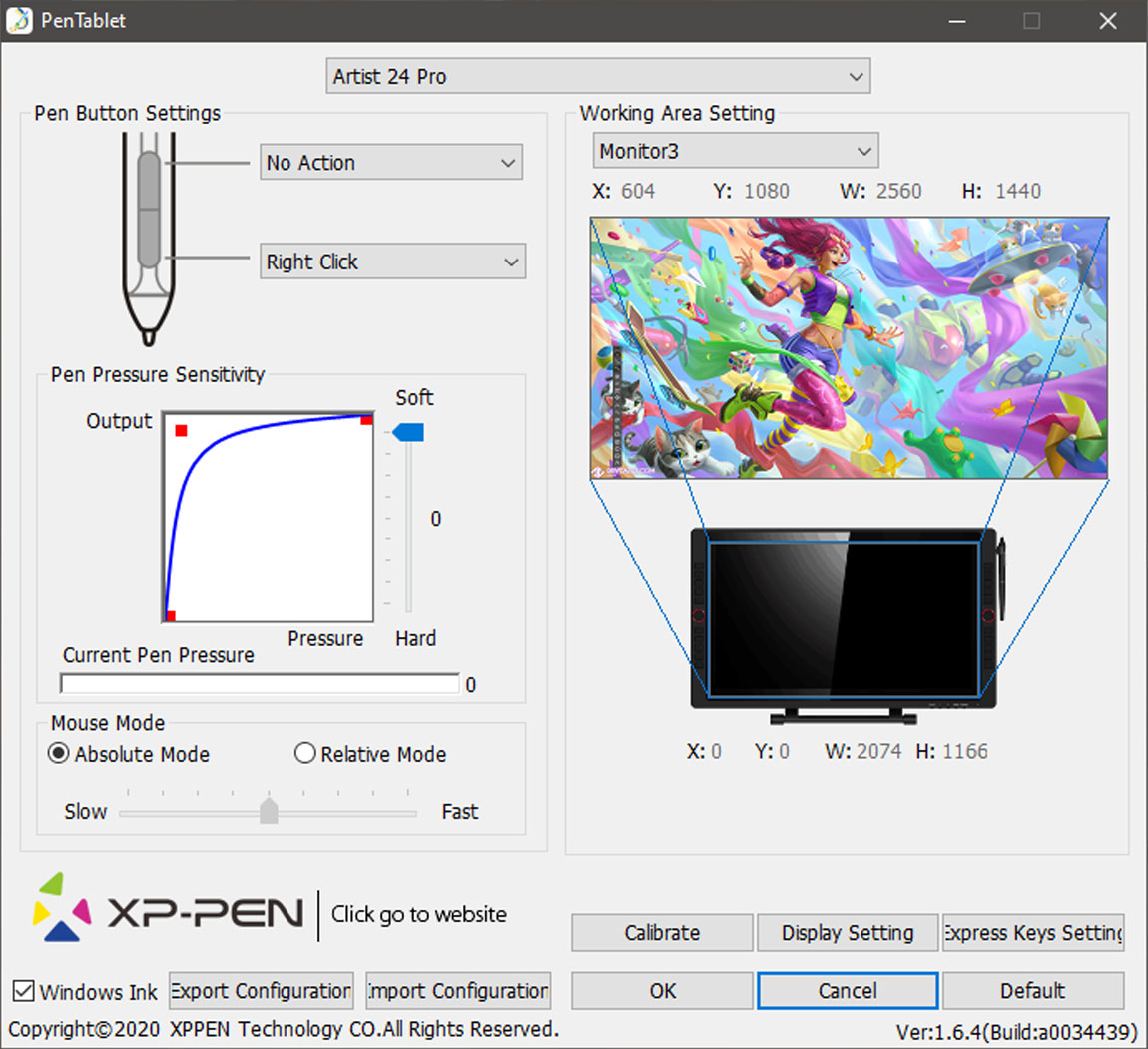

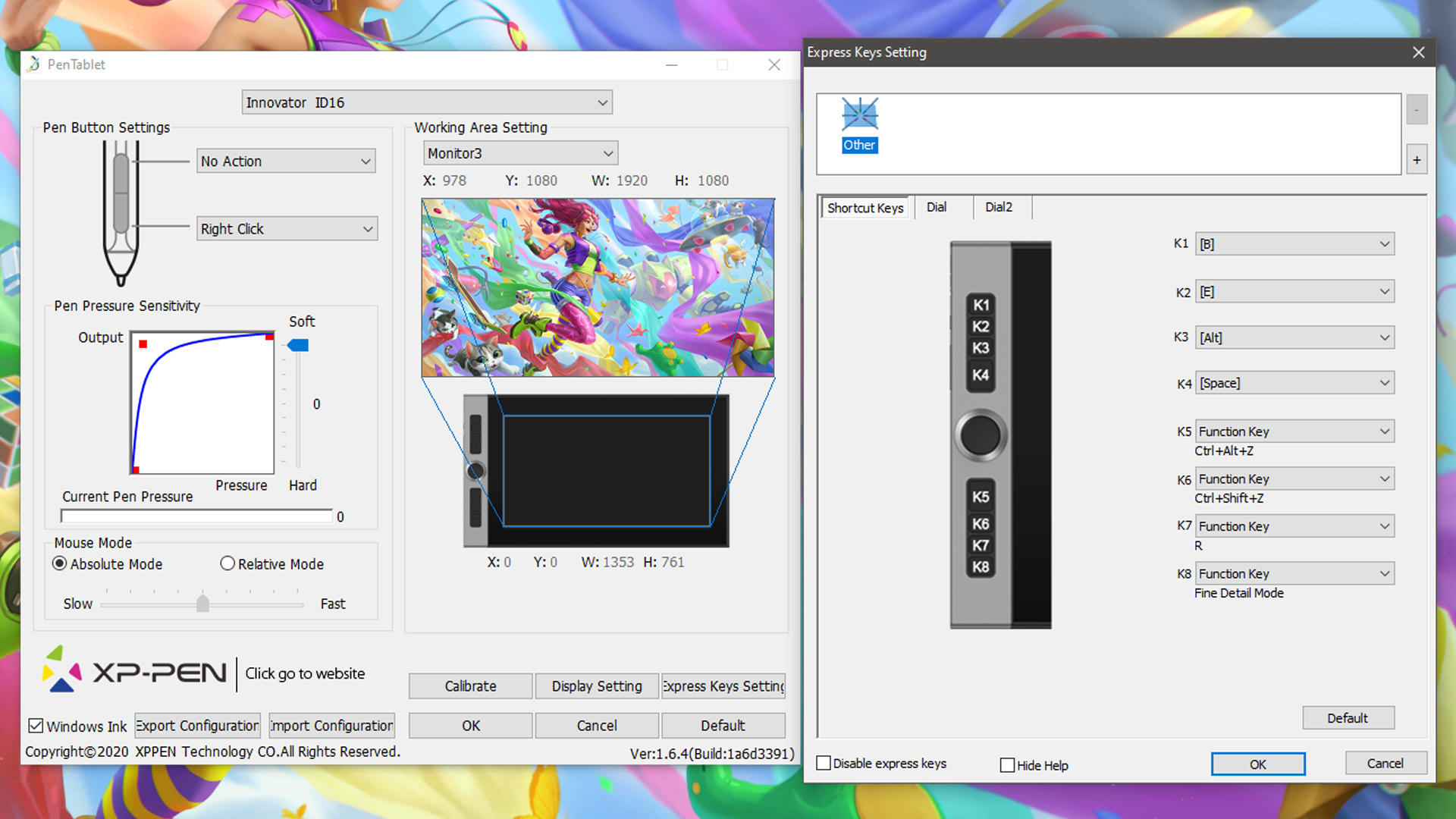

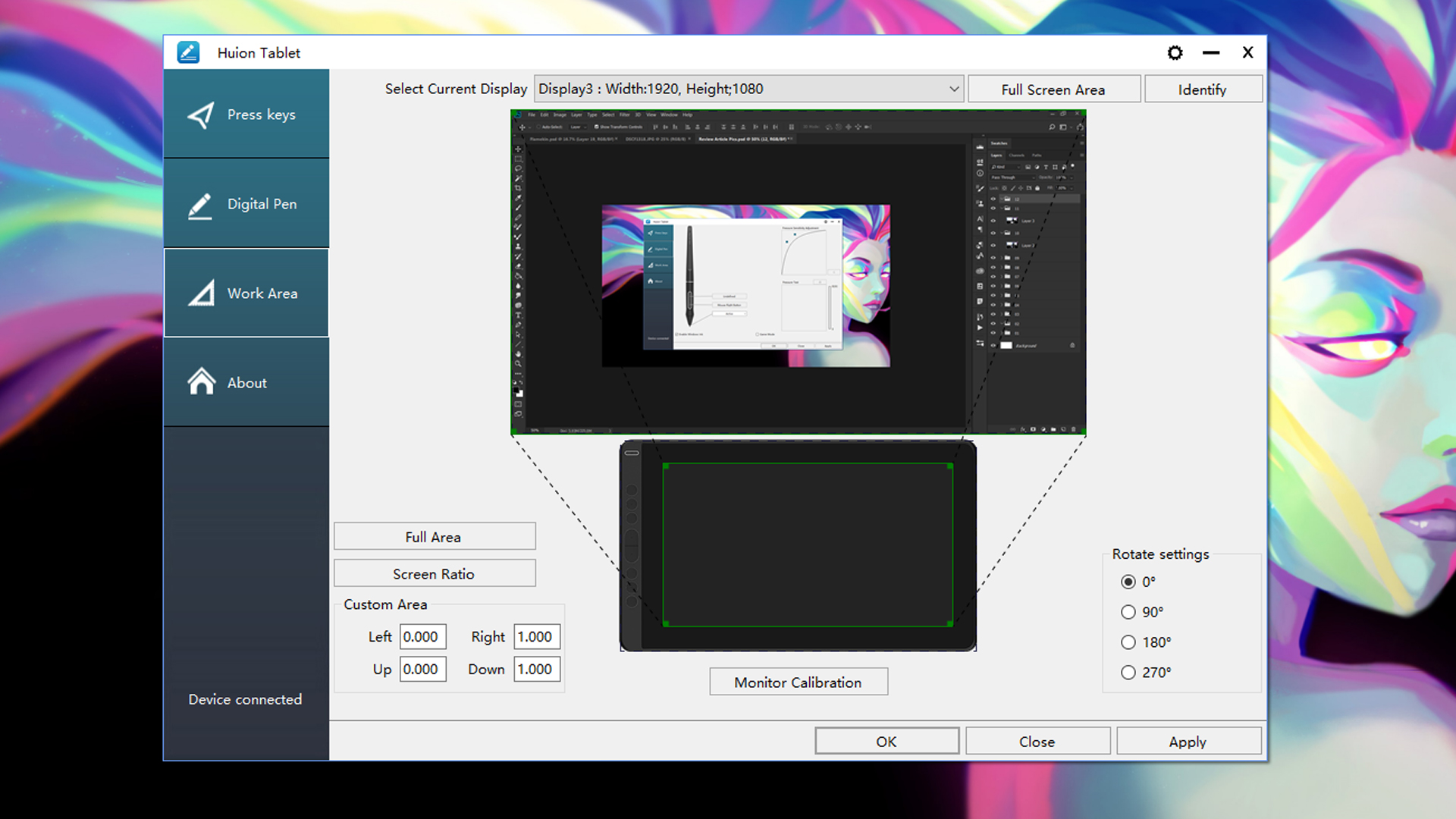

The software is very straight forward. I did not encounter any bugs while using it on Windows 10 and Photoshop CC.

The 8 Press Keys can be customized but the default settings are already very useful. Right now my settings are Brush, Eraser, Zoom in, Zoom out, Brush Enlarge, Brush Shrink, Pan, Undo. I think it would be better if there was one more button for a Redo function though.

Here are my Pen settings. As usual I set it to be more sensitive than usual so that it will need less pressure from my hands to prevent RSI.

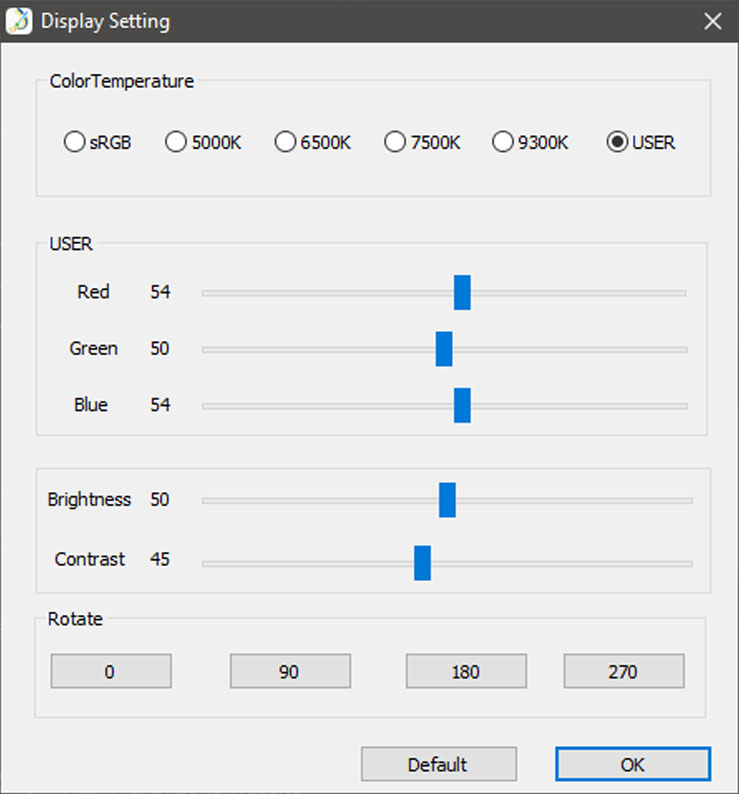

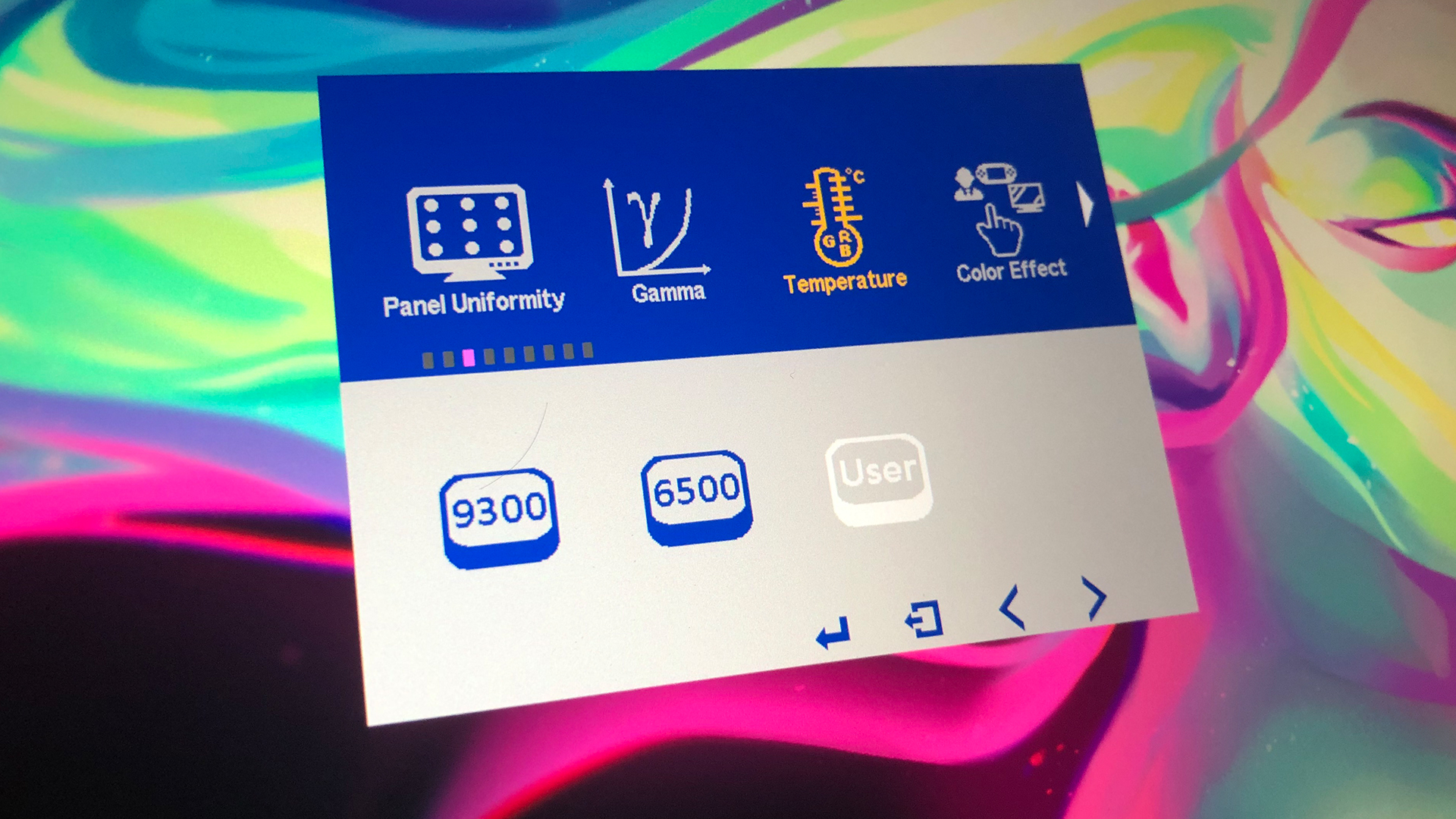

To adjust other display settings, they can be found in the OSD which is a bit tricky to navigate. I recommend setting the color to “User” for more accurate results. I lowered the Blue value to 117 to match my other monitors. I wish this feature was in the software instead of using the buttons to change the values.

Screen Quality

The screen is a full HD (1920 x 1080 pixels) IPS screen with a replaceable anti-glare protective film. The pixel density is sufficient for this size. It gets a bit warm on the area near the sockets.

Colors

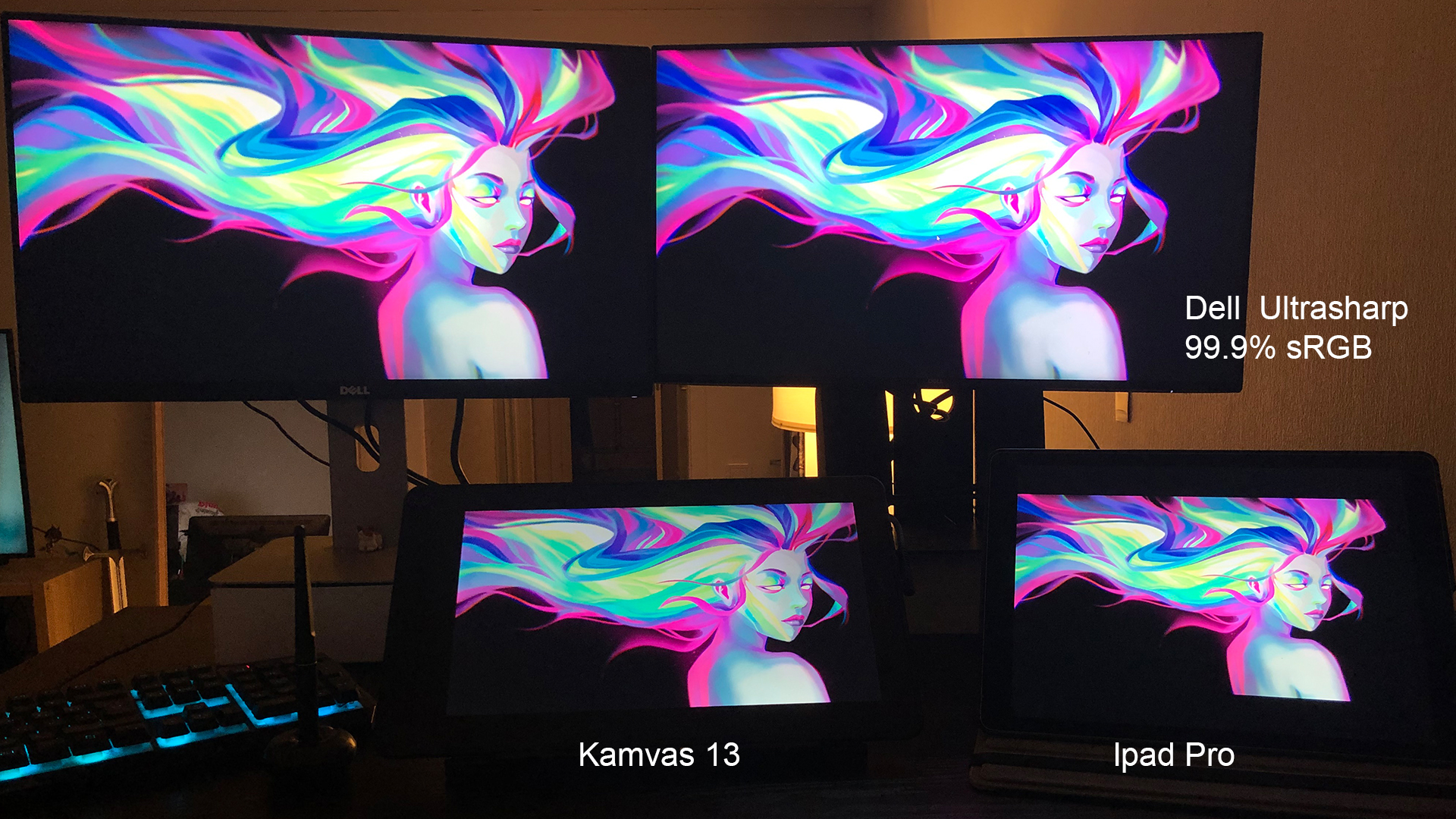

The colors feature 120% sRGB with a 178° viewing angle. After a changing the color temperature to “User” it looked a lot more accurate. It comes very close to my Dell UltraSharp and Ipad Pro screens which are both the top benchmarks for screen colors. I’m impressed something this affordable can reach this quality.

PROS

- Sleek build weighing only 980 grams which is perfect for mobile workstations

- Only 239 USD for a high quality display tablet. (price does not include stand)

- Battery Free Pen Stylus with 10 spare nibs

- Artist Glove and cleaning cloth included

- 8 Customizable Press Keys

- Great screen quality (IPS 1920x1080px, 120% sRGB, minimal parallax)

- Easy to set up

- Supports USB-C to USB-C for many laptops

- Supports connectivity with many Android devices

CONS

- Adjusting the colors using OSD mode just like a regular monitor is a hassle when this feature should be in the software settings instead.

Summary

Overall, the Kamvas 13 is a solid device for such an affordable price! Artists these days are very lucky that products like this exist! I highly recommend this product especially to artists with a limited budget and for those who need a mobile display tablet. This is a bit too small for my regular work but this is perfect whenever I need to travel and do art on my laptop.

Check out their link below!